Matchless Tips About How To Reduce Withholding Tax

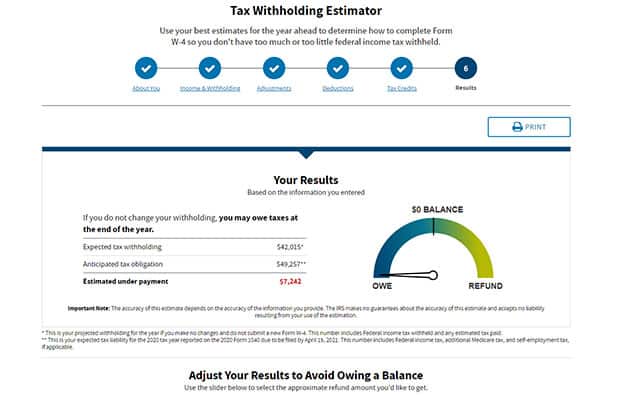

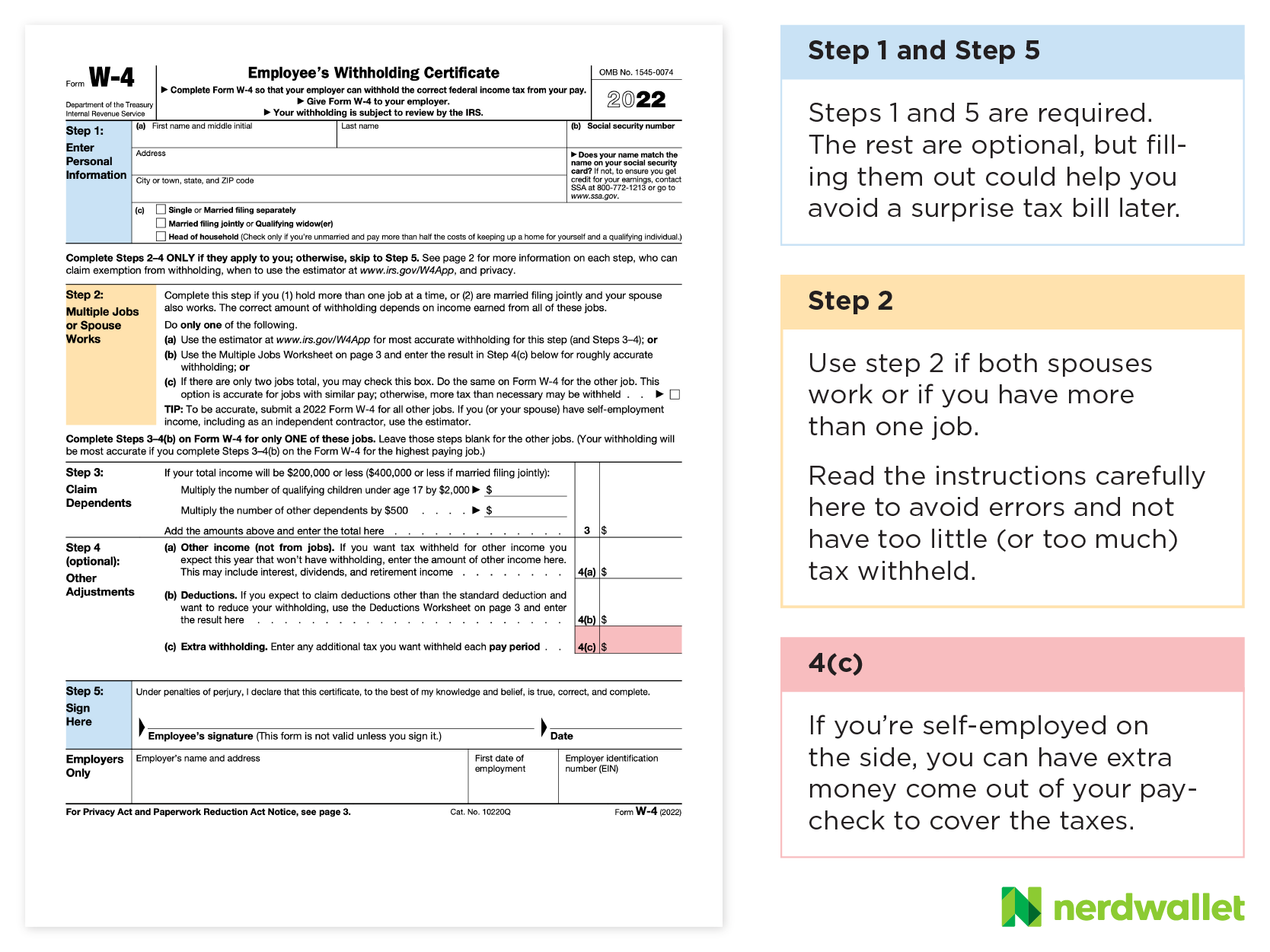

To change your tax withholding, use the results from the withholding estimator to determine if you should:

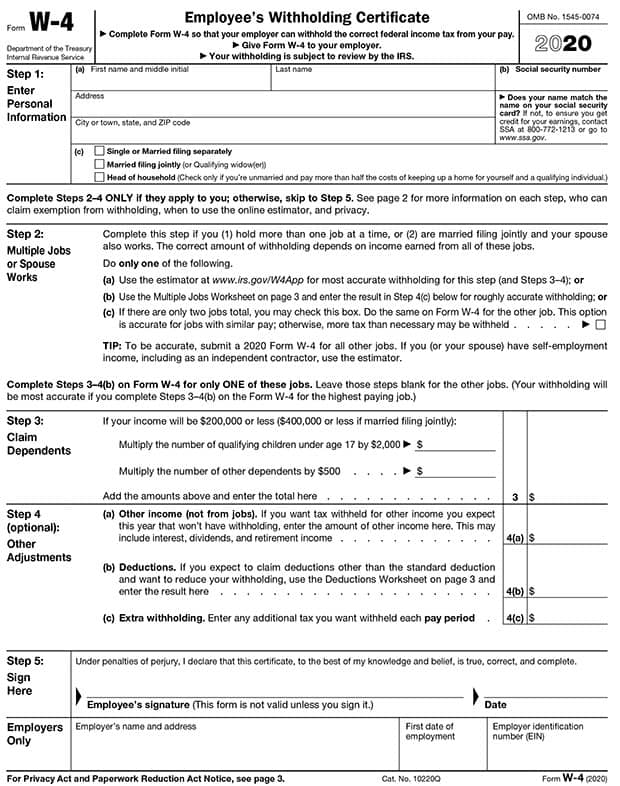

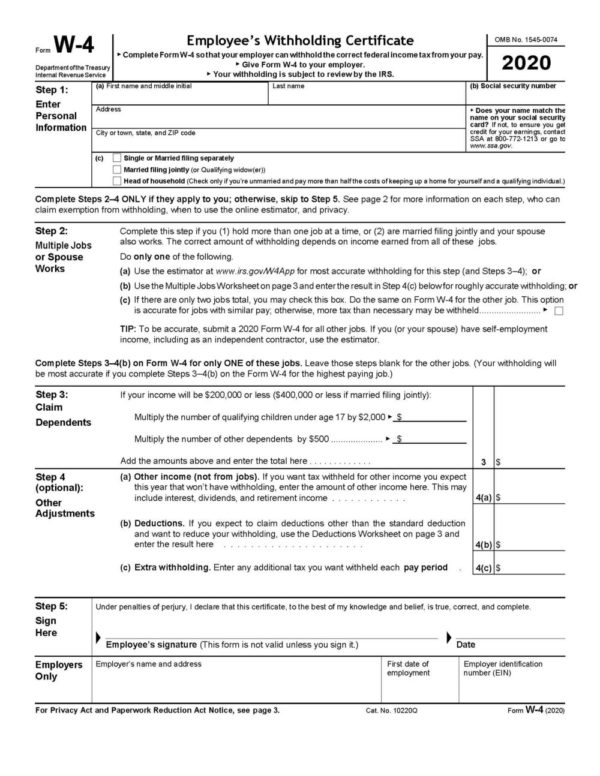

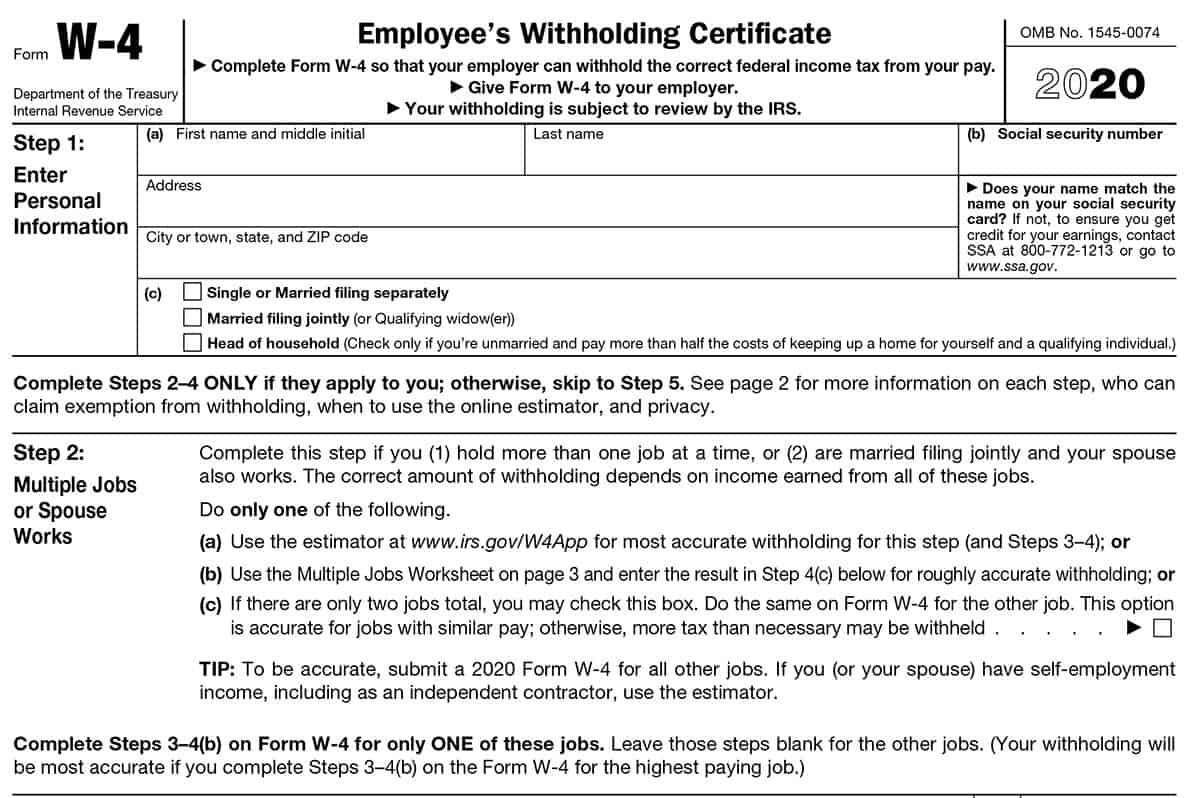

How to reduce withholding tax. Visit the irs’s withholding online calculator. Continue through the screens, entering the. Use the irs tax withholding estimator to complete the form, then submit it to the payroll department where you work.

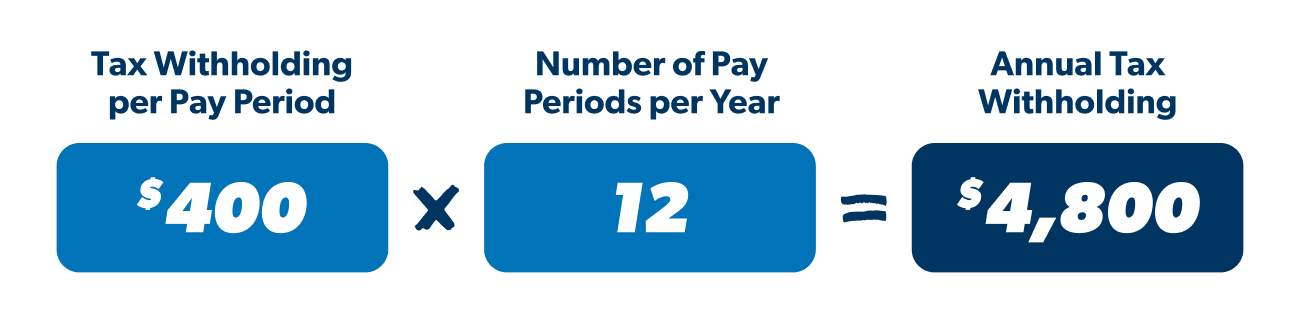

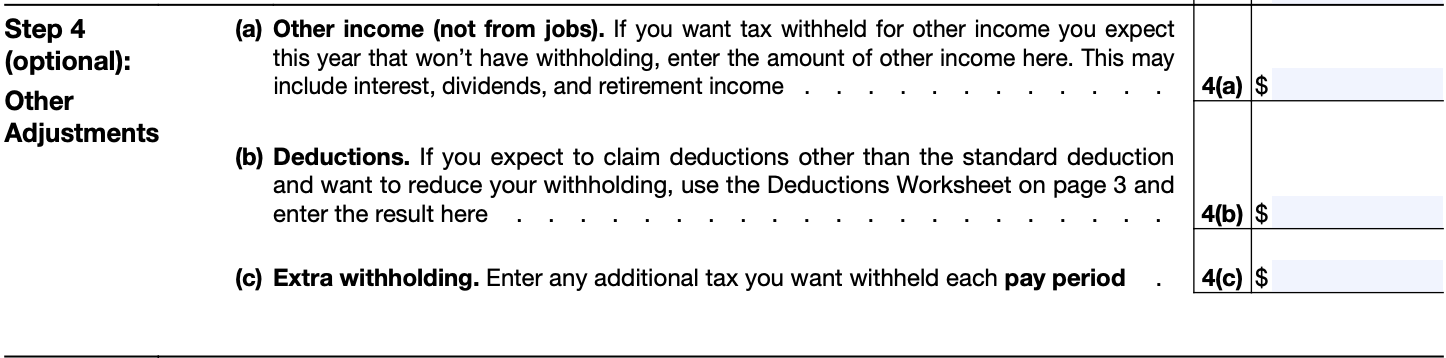

Taxpayers with more complex situations may need to use publication 505 instead of the tax. How to reduce tax withholding step 1. Reducing tax withholding rate just as you can claim exempt status to stop taxes withheld from your paychecks, you can reduce the rate as well.

Enter your information in the calculator and determine your. Use the instructions in publication 505, tax withholding and estimated tax. Use the same tax forms you used the previous year, but substitute this year's tax.

That’s a ballpark figure for how much extra you could earn, every month. A good first stop is with the irs tax withholding estimator, which asks you about your filing status, number of dependents, income amounts, income sources, adjustments to. To reduce the withholding tax, a global investor must choose an etf domicile that has an advantageous tax treaty with the us, since us equities have a weight of over 50% in.

To register your tax residence and apply a reduced tax withholding rate on your mintos account, we are required to receive a tax resident certificate from you. This is better for taxpayers that still have. Now, here’s where that “making money” thing comes in.

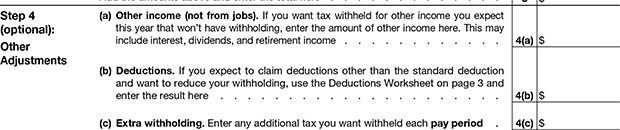

Check with your local tax. To reduce tax withholding, an employee must increase their number of withholding allowances.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)