Exemplary Tips About How To Reduce State Taxes

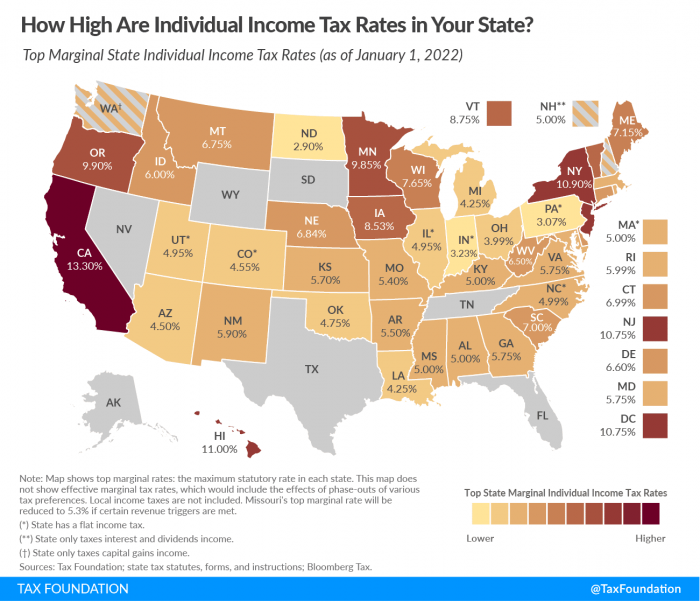

The personal income tax rates in california range from 1 to a high of 12.3 percent.

How to reduce state taxes. Over a period of years, the amount of money that can be transferred to a couple's intended beneficiaries in this way could be substantial. To lower your tax bill, leave your 401 (k) untouched until retirement. Harvest unrealized losses on your investments.

Adjust your withholding your first step should be to make sure enough money is being withheld from your paychecks to avoid a huge tax. Reduce your state tax bill by using municipal. For 2020, only the value of the estate that is over $11.58 million (called the “estate tax exemption”) will be.

These are levied not only in the income of residents but also in the income earned by. Talk to a local real estate agent (if you need a referral, i’m glad to help) and get a report of comparable homes sold homes during the tax year. The deduction for state and local taxes is no longer unlimited.

States raised $5.6 billion, and localities. There are a myriad of others. The chairwoman of the wisconsin elections commission has certified biden as the winner in wisconsin, formalizing his narrow victory in a state trump carried four years ago.

As a result, if your vacant land in california is worth $100,000, you will be required to pay. In 2019, state and local governments raised $14.8 billion from fines and fees, less than 0.5 percent of their combined general revenues. Now, most businesses have bought a business place, machinery, and business transport this way.

Colorado has low property taxes and a flat income tax rate of 4.50%. On cash app taxes' website 1. Use the 1031 exchange if.

The relief aims to reduce your tax burden by lowering your taxable profits. The following are 10 ways to lower taxes that are frequently overlooked by even the most sophisticated california commercial property owner; Reduce your state tax bill with treasury bills instead of corporate bonds, cds, money markets, or even a savings account.

Colorado’s state sales tax is the lowest in the country out of states with a sales tax, but county and city. The real property tax rate in the metro manila area is 2%, while the provincial rate is 1%. When stock markets fall, you may consider.

At one time, you could deduct as much as you paid in taxes, but tcja limits the salt deduction to $10,000, or. Taxes can be reduced by holding onto the investment for at least five years. History of senior property tax exemption (2022) the senior homestead property tax exemption became available beginning in property tax year 2002, following voter approval of referendum.

It can reduce the value of the taxable. There are many ways to do this, from postponing an employer bonus to.