Impressive Info About How To Lower My Efc

![How To Lower The Efc [Legally] – College Reality Check](https://images.squarespace-cdn.com/content/v1/596d43f5d2b8575f4b4615dc/1531166884042-OLL4KI13J8WGZKOVZ1OB/Green+and+Yellow+Simple+Reading+Reward+Chart.jpg?format=1000w)

While not guaranteed, colleges may consider special circumstances and reduce your efc.

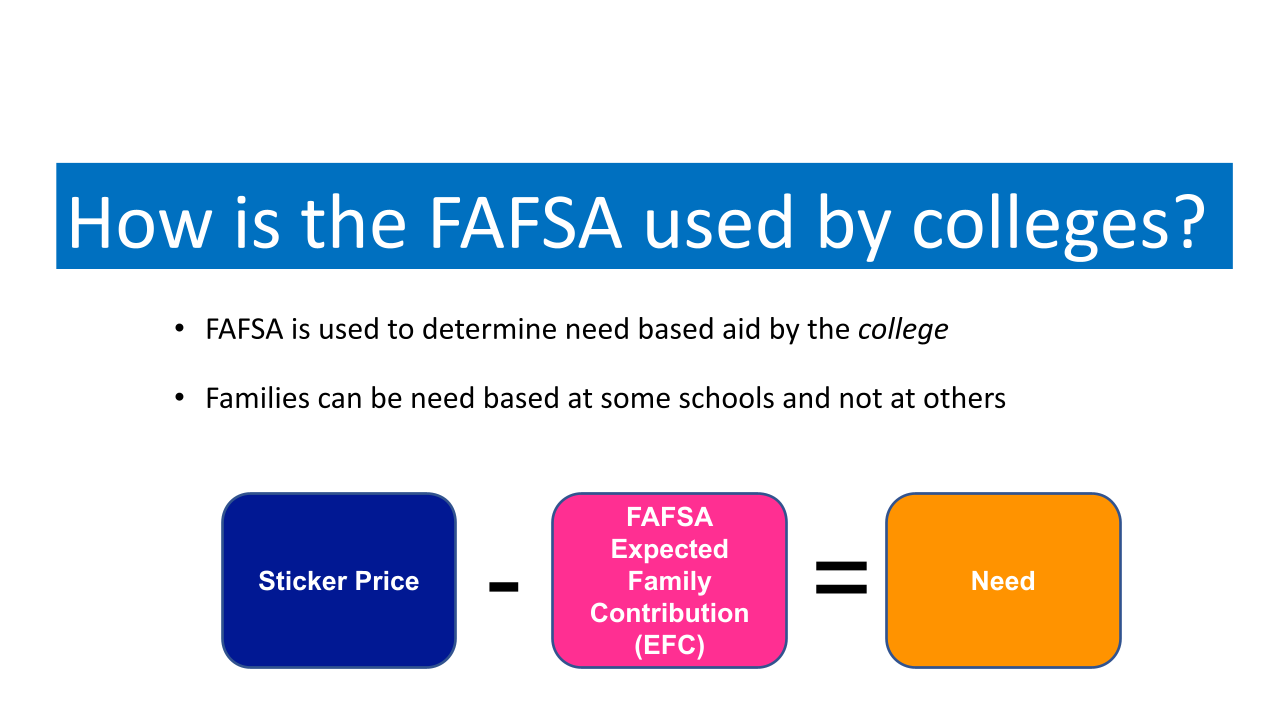

How to lower my efc. Use cash to pay down debt having debt like credit cards or car loans doesn’t reduce your eligibility for financial aid, but having cash does. Unfortunately, it’s difficult to reduce an efc except at the margins. Here’s how to reduce efc for college:

College planning source is here to help with online assessments that meet your family’s specific needs. The lower your income, the less your efc will be. Each year, students lose their merit scholarships.

The best way to lower your expected family contribution is by getting a job while you’re in college. This can help reduce the. Your income is a major driver of how much your efc will be.

One resource that i would suggest would be tuitioncoach. While your assets are important in the calculation, the largest factor in the efc is income, said peter mckenna, a certtified financial planner with highland financial in riverdale. On the subject of protecting the prices of upper training, your anticipated household contribution (efc) is among the largest components that comes into play.

Work as few hours as possible, or find more deductions to lower your adjusted. As you do have to report you alimony and child support there is probably little you can do to reduce your efc. Other ways to reduce efc make a special conditions request:

Start planning for college the smart way. Your merit scholarship may not be renewed each year.

![How To Lower The Efc [Legally] – College Reality Check](https://collegerealitycheck.com/wp-content/uploads/college-money-1025.jpg)