Beautiful Work Tips About How To Get Rid Of Personal Guarantees

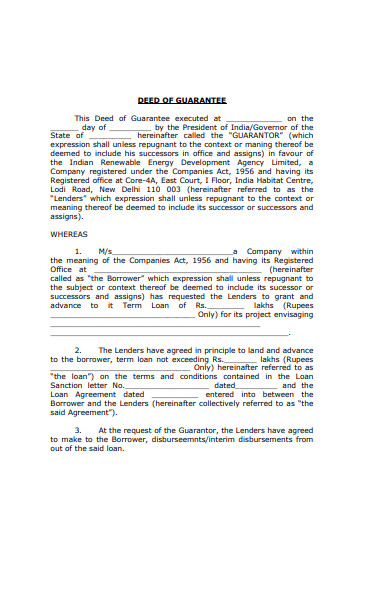

To get out of a personal guarantee on a commercial lease in the uk, you will need to give written notice to your landlord of the intention to end the lease early, but if the terms have been.

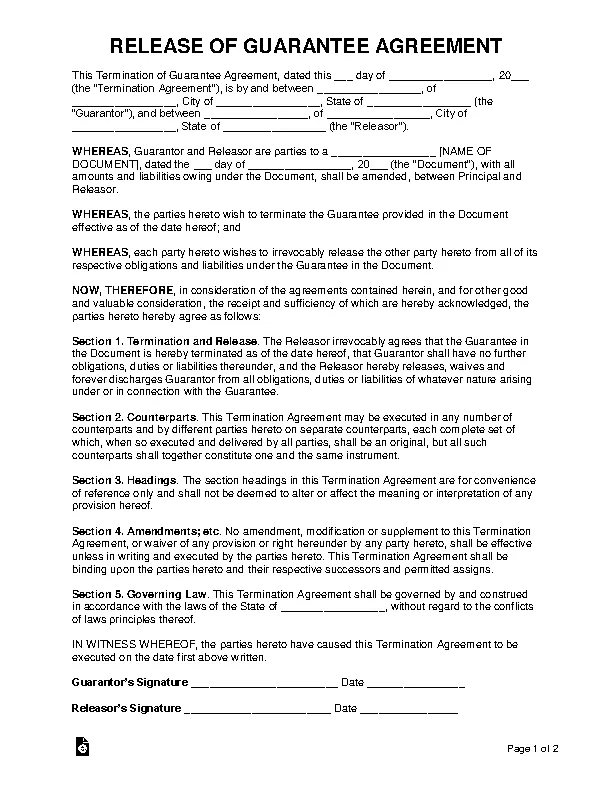

How to get rid of personal guarantees. Here are some scenarious in which you could: It’s important to note that if you file a chapter 11 bankruptcy and you are able to. Those types of actions can be reversed by the court, and those assets could.

Bankruptcy can eliminate a personal guarantee on both business loans and personal loans. It's relatively common for a business owner to file individual. Consequently, filing a chapter 7 bankruptcy will wipe out all liability including the personal guarantee.

You may be able to forgo a personal guarantee by offering collateral or increasing your collateral — a personal guarantee might only cover a certain percentage of the debt. Getting rid of a personal guarantee agreement once it’s signed is extremely difficult. Read this blog to find out how bankruptcy might help you get rid of a personal guarantee.

An individual can discharge a personal guarantee. The following are some pointers of reducing your personal exposure under the personal guarantee. How to get out of a personal guarantee on commercial lease?

Business bankruptcy typically doesn’t get you out of a personal guarantee — only personal bankruptcy. Something that the courts could undo, so give away a property to a relative, put some assets in an llc or a trust. In part one, remarkable truth about personal guarantees, we explained what a personal guarantee is and the risks that they present to the business owner.

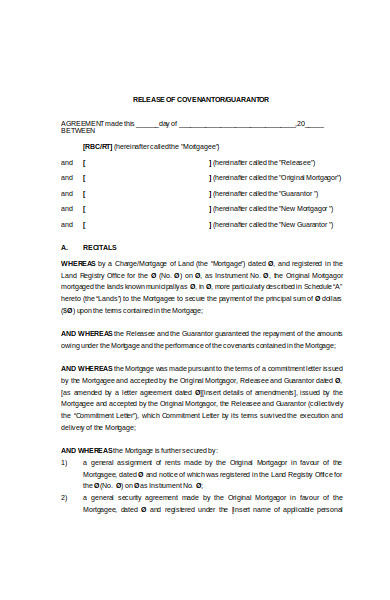

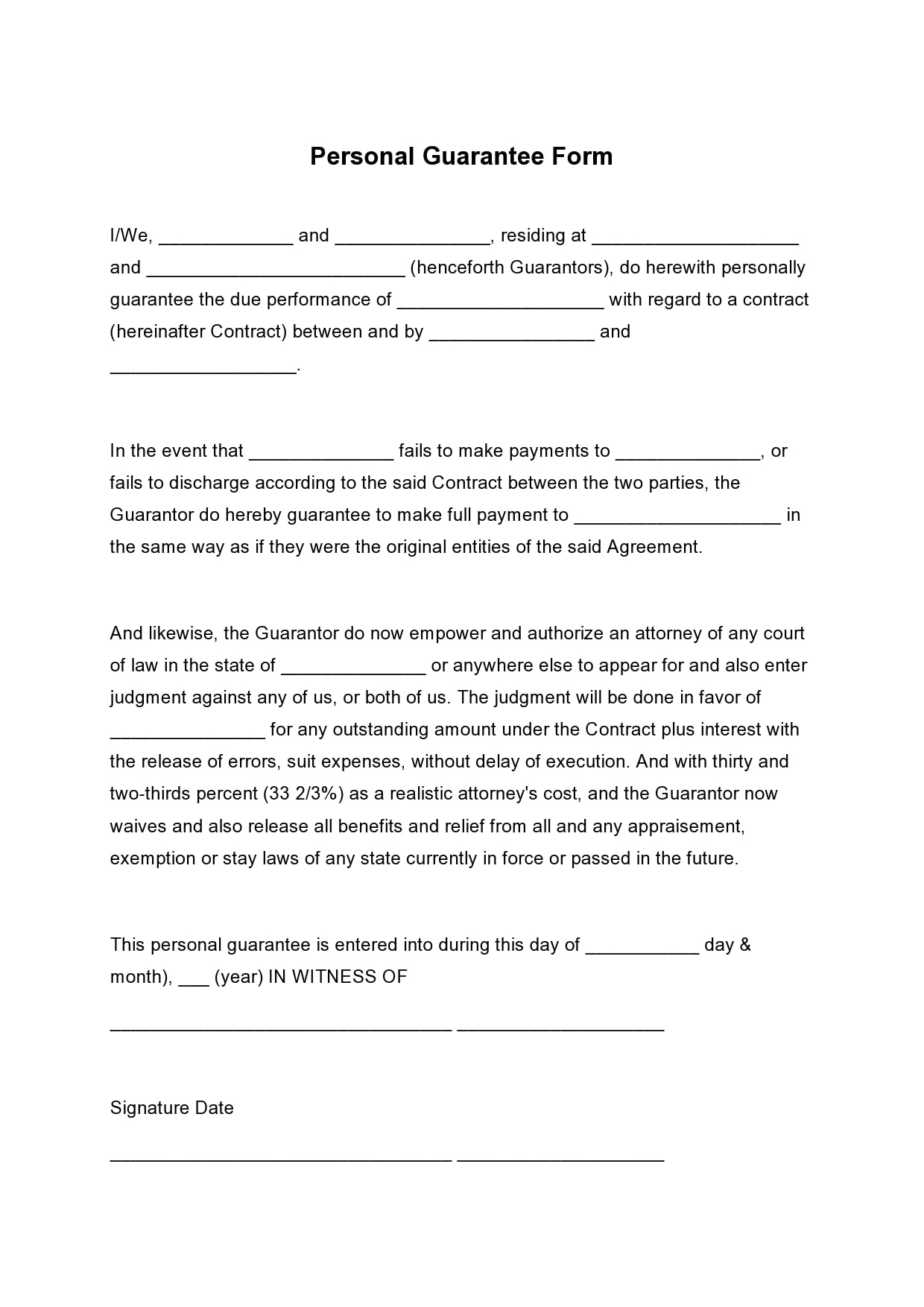

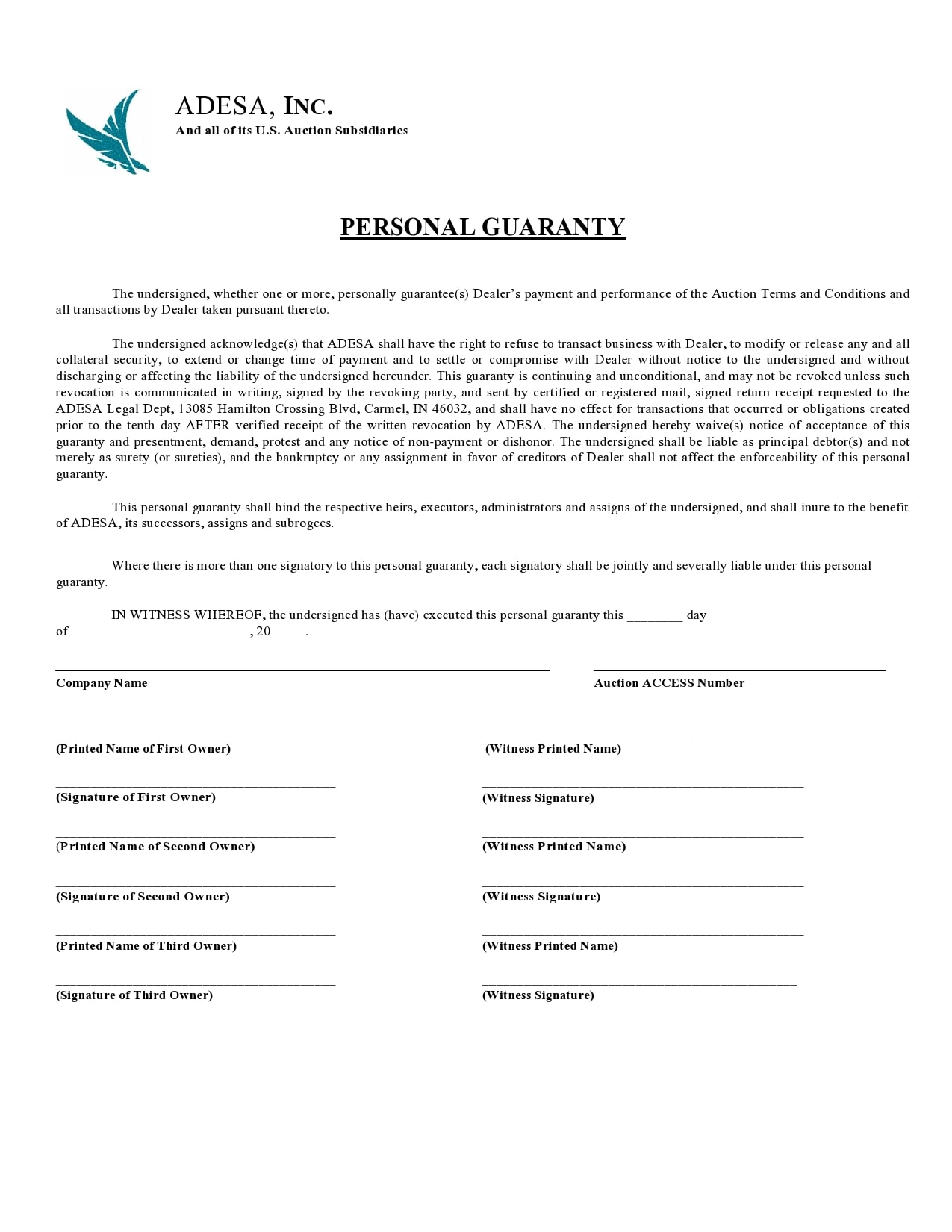

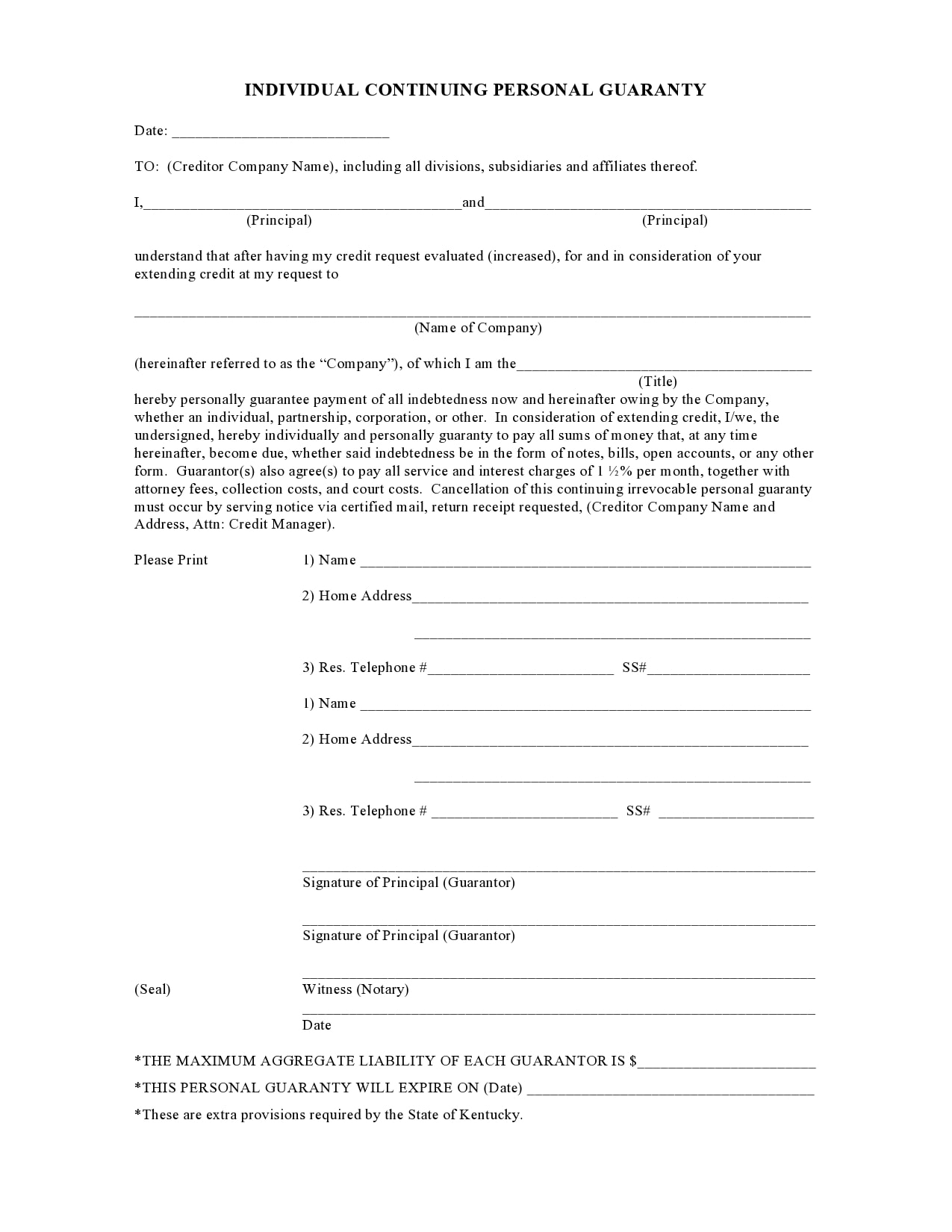

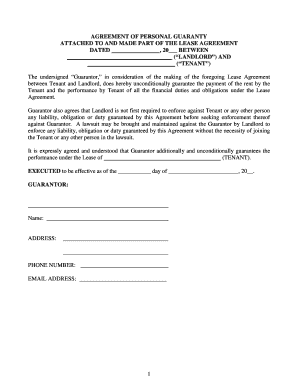

A personal guarantee is a legal promise made by an individual to repay credit issued to their business using their own personal assets in the event that the business is. By signing the guarantee, you agreed to use your personal assets to pay. A personal guarantee is an agreement whereby an individual (the guarantor) agrees to satisfy the contractual obligations of another party, in.

Personal guarantees and the law. Also, keep in mind that. Subleasing the space to another tenant.

It’s relatively common for a business owner to file individual bankruptcy to get rid of a personal guarantee—and most personal guarantees will qualify for discharge. If, however, the business remains operational but you are no longer involved in the business due to buyout, divorce, etc., you will want the sba to release you from. You can try and limit the amount of time you will guarantee the lease term.

Within commercial banks, loan officers are rewarded whenever they can. Since a personal guarantee is an individual obligation, most people eliminate it by filing for bankruptcy themselves rather. The starting point to negotiating your way out of a personal guarantee is to first understand why they are requested.

I mean you can get rid of personal guarantees only if you sell your business and are released from the guarantee, or if you personally file for bankruptcy, said zach reece, a. Subletting the space to another tenant is often the easiest way to.